All ACA plans must cover the same set of essential health benefits. The essential benefits include all vital services such as hospital services, doctor visits, diagnostic tests, emergency room care. All the foregoing conditions will also be covered.

How to qualify for a subsidy?

Private insurance companies organize plans by categories named for metals. Each metal contains a different category of premiums, deductibles, and copays to meet specific health and financial requirements.

Bronze

- Minimum monthly premiums

- Maximum deductibles and copays

- Plans to cover serious sickness or injury cases

Silver

- It is the most prevalent plan category

- Moderate monthly premiums

- Moderate deductibles and copays

- The plans are authorized for cost-sharing subsidies

- Plans with a greater monthly premium for more health care coverage

Gold

- Higher monthly premiums

- Low deductibles and copays

- Plans for higher monthly premiums for more routine care costs coverage.

Platinum

- Maximum monthly premium

- Minimum deductibles and copays

- Plans for people demanding a lot of care and are eager to pay a very high premium.

ACA Subsidies

Premium tax credit

- It lowers the monthly premium for eligible. The income identifies how much a person qualifies for the premium tax credit.

- When a person qualifies for a premium subsidy, the federal government will pay that amount of the tax credit to the health plan. He will only have to pay his portion. Or they can get tax credit while filing income taxes.

Cost-sharing subsidy

- People qualifying for a premium tax credit may also be eligible for a cost-sharing reduction. It will help them pay deductibles and copays.

- People who enroll only in the silver plan can get these savings. Those who qualify for this additional subsidy will get a specifically designed plan.

How to qualify for a subsidy?

- The income added to your application will determine whether you qualify for a premium tax credit or not.

- You can find your eligibility from the healthcare.gov calculator.

- While estimating subsidy, must add yourself, your spouse, and dependents on your income taxes.

Ready to apply? Provide personal information

- Name and date of birth of you, your spouse, children, and all dependents under 21.

- Your mailing addresses

- Social Security numbers of all listed on the application

- Information from immigration documents will be required for legal permanent residents

- Brief Tax information

- Health coverage information

- Employer information and contact number

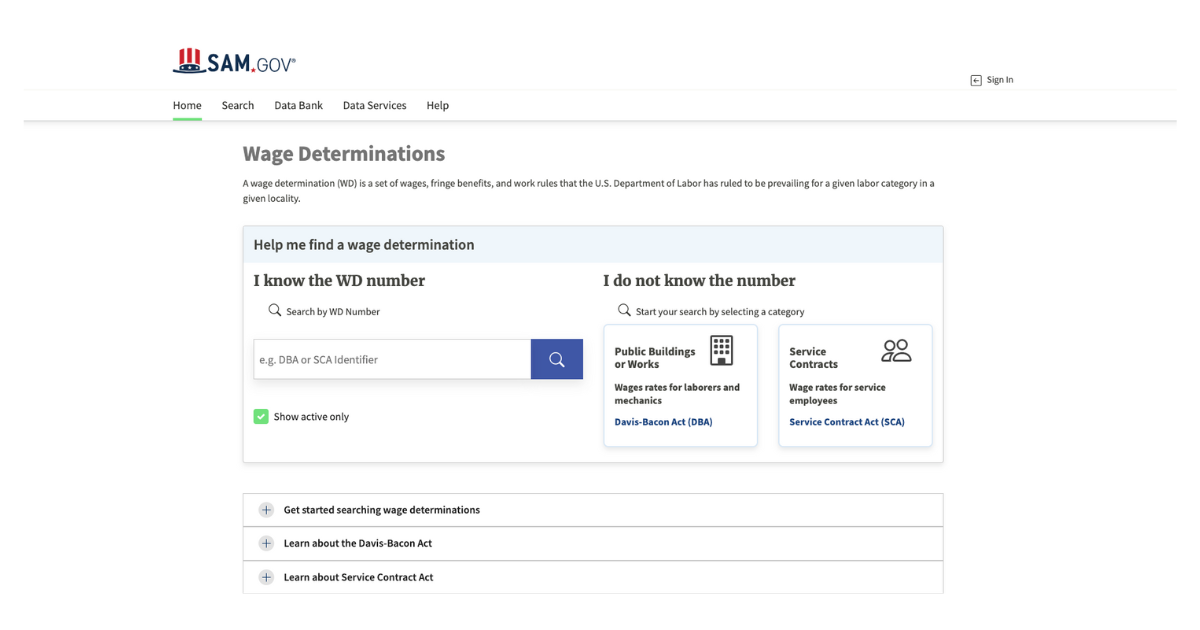

How and when to apply

- Fill out the application on healthcare.gov

- The last date of this special enrollment period is Aug. 15.

- The coverage will start from the first of the month after you apply.

- In case of a life-changing event, you may apply at any time of the year.

- Usually, the ACA open enrollment period begins from 1st November and ends on December 15.

Takeaway:

All ACA plans must cover essential healthcare benefits. The benefits and premiums are characterized in special categories on metal names. Based on the person’s income on the application, they may apply for tax subsidies. While applying for ACA healthcare insurance, employees must be asked for their basic contact, family, and job information. In case of any confusion, employers must contact insurance agents on healthcare.gov.

.png)