The IRS and Treasury Department released Notice 2015-87. The IRS Notice 2015-87 addresses the impact of cafeteria plan flex credits, opt-out payments, and Health Reimbursement Account (HRA) contributions on affordability determinations. The IRS Notice 2015-87 also contains welcome clarifications of the fringe benefit payments under the McNamara-O'Hara Service Contract Act (SCA).

What Topics Does The IRS Notice 2015-87 Cover?

The IRS Notice 2015-87 covers many essential topics, such as:

- Application of Code § 6056 to the government entities

- Application of ACA's insurance market reforms to HRAs

- Application of COBRA continuation coverage rules to unused funds in health FSA carry-overs

- Exemption from sanctions under Code § 6721 and § 6722 for employers who make great efforts to comply with the ACA reporting rules

- Application of health savings accounts' rules to people eligible for benefits administered by the Department of Veterans Affairs

What is an Employee's Required Contribution?

The amount of an employee's required contribution to determine affordability is determined under the ACA's individual mandate rules. The term "required contribution" means:

"In the case, a person is eligible to purchase Minimum Essential Coverage (MEC), which consists of coverage from an eligible employer-sponsored plan. The part of the annual premium that the person will pay for self-only coverage is required contribution."

HRA Contributions

In the case of an HRA, the amounts made available for the current plan year are counted towards the employee's required contribution that an employee can use:

- To pay premiums for the eligible employer-sponsored plan

- For cost-sharing or other health benefits not covered by the plan

The HRA must meet the requirements for integration with the major medical group health plan.

Opt-Out Payments

An opt-out payment is an arrangement under which an employer offers an amount to an employee that can't be used to pay for coverage under the employer's group health plan. According to the regulators:

"An employee who has to reduce their compensation by $1,000 to pay for employer-provided health coverage has a choice similar to an employee who does not have to pay anything for employer-provided coverage. But, the latter can receive an additional $1,000 in compensation if they refuse coverage."

It means that an opt-out payment can increase the employee's contribution for health coverage beyond the amount of any wage reduction contribution.

Cafeteria Plan Flex Credits

The ACA's individual mandate rule provides that a flex contribution reduces the employee's required contribution if the employee:

- uses the amount to pay for MEC

- uses the amount to pay for medical care

- may not choose to receive the amount as a taxable benefit

A contribution under a plan that meets all three criteria is called a health flex contribution. The health flex contribution reduces an employee's required contribution dollar-for-dollar. The employer flex contribution besides health flex contribution does not reduce an employee's required contribution. The IRS and Treasury Department explained in the IRS Notice 2015-87 that:

"The treatment of a non-health flex contribution is different from the treatment of a health flex contribution and an HRA contribution. The correct measure of an employee's required contribution is the compensation amount that the employee can apply to something besides health-related expenses. So, the employee must forgo to receive coverage under the employer's health plan."

Fringe Benefits Under The McNamara-O'Hara Service Contract Act

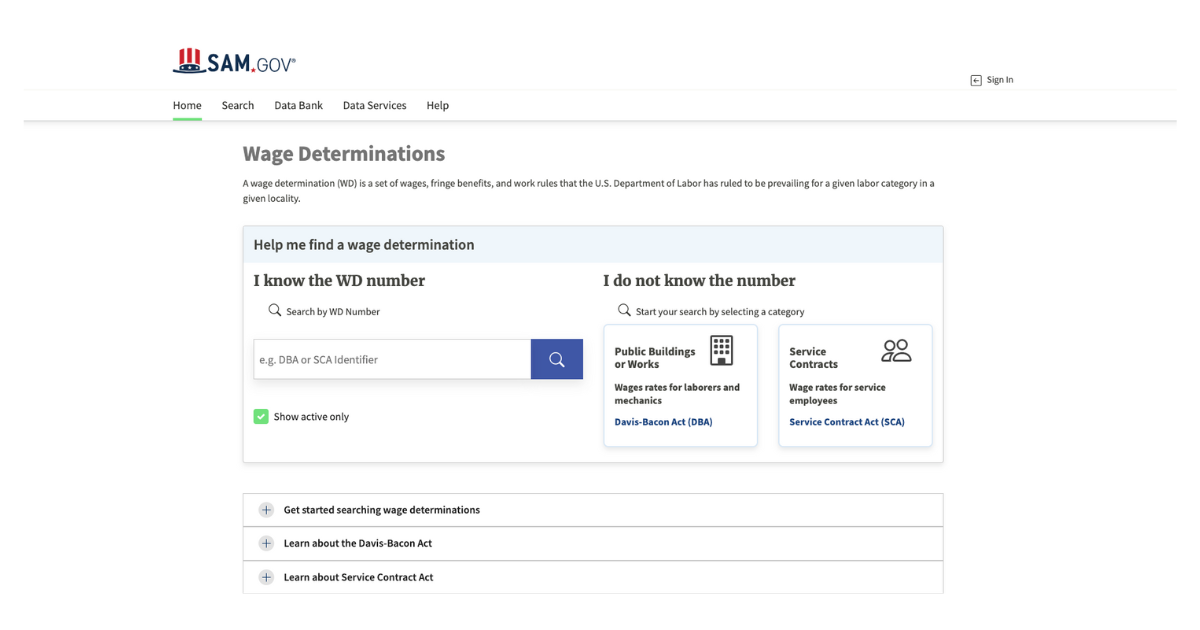

The SCA requires that employees working on specific federal contracts must receive prevailing wages and fringe benefits. An employer can meet its fringe benefit obligations by providing a specific benefit of sufficient dollar value.

In most cases, an employer can meet its fringe benefit obligations by providing the cash equivalent of benefits or a combination of cash and benefits. It can allow employees to choose between different benefits or between different benefits and cash.

Takeaway

The IRS Notice 2015-87 addresses several questions and issues that have dogged employers and their advisors for a while. Not everyone will be happy with the notice's treatment of HRA contributions, opt-out payments, and cafeteria plan flex credits. However, this dissatisfaction is misplaced.

.png)