Are you looking for simple tools to make your annual ACA reporting a breeze?

The Affordable Care Act (ACA) has expanded health coverage to a broad range of Americans, but it has also expanded the amount of IRS paperwork required to keep track of that coverage.

Filing paperwork the manual way is certainly possible, but it's bound to take a long time and it’s easy to make reporting mistakes. Luckily, there are some great ACA reporting tools available to automate and simplify the process. Let's take a look.

The Affordable Care Act: A Brief Definition

In March of 2010, the Patient Protection and Affordable Care Act, commonly known as the Affordable Care Act, was passed into law. Its general aim was to provide health insurance to more Americans. Its more specific aims include three things:

- Expansion of healthcare coverage

- Improvement of healthcare quality

- Remodeling of insurance industry regulations

In the 12 years since its passing, progress has been made in all three areas.

Overall healthcare coverage was expanded only a few years after the ACA passed into law.

Healthcare quality has improved as well through the wider availability of prescription drugs and specialty services. Also, the expansion of Medicaid seems to have lowered cardiovascular-related deaths.

Insurance industry regulations have been remodeled to allow people with cancer, diabetes, and other pre-existing conditions to get health insurance coverage more easily than before the ACA passed.

How to Report Your ACA Information Correctly

Before filing IRS paperwork with your ACA data, it's important to determine if you're required to do so.

Most small businesses with less than 50 employees don't need to worry about year-round record keeping to comply with ACA regulations. All Applicable Large Employers (ALEs), however, do need to ensure accurate ACA reporting every year.

Although the IRS has a detailed report on what constitutes an ALE, the general definition is a company with 50 or more full-time (or full-time equivalent) employees. Usually, one of those employees is an HR professional who makes sure the company is compliant with all ACA regulations.

This can get quite tricky and time-consuming — especially when trying to fit it in with other HR tasks ranging from recruitment and screening of new applicants to benefits and compensation of existing employees.

Regardless, it needs to be done.

Usually, this means keeping track of the employee data for 50+ workers who may be dispersed at multiple locations. To do this manually requires a lot of time and effort as you pore over payroll slips to fill out the right 1095 form for each employee. This repetitive manual process often leads to errors on the IRS paperwork, which often come with hefty penalties.

Penalties for Inaccurate ACA Reporting

As part of the ACA's Employer Mandate (officially called the Employer Shared Responsibility Provision), ALEs must offer minimum essential coverage (MEC) to 95% of their full-time employees.

To qualify as MEC, the coverage must be affordable and provide minimum value. Affordable coverage should cost less than 9.5% of an employee's annual salary. Providing minimum value means it covers roughly 60% of average health care costs.

If an ALE fails to do this, then a sledgehammer penalty or tack hammer penalty can occur.

A sledgehammer penalty occurs if 95% of the workforce isn't offered coverage. It costs about $2,700 per employee. The tack hammer penalty occurs if coverage is provided but it isn't affordable or it doesn't provide minimum value. It costs about $4,120 per employee.

If there's a problem with your IRS paperwork, then they will first send you Letter 5699. This informs you of the inconsistency and asks you to confirm certain information and details. If the IRS decides to incur penalties, then they'll send Letter 226J notifying you of them.

Over the years, the IRS has become less forgiving with penalties. For example, in 2021, they ended the Good Faith Transition Relief, which provided some buffer room for mistakes.

If this all seems overwhelming you’re not alone. Fortunately, there are ACA reporting tools that are available that ensure accuracy and ease the burden.

Tools to Simplify Annual ACA Reporting

Now more than ever, it's essential to make sure your ACA reports are accurate and sent in on time, otherwise you will incur penalties.

Doing this manually is time-consuming, and you can make errors. Doing it automatically, however, is simple and accurate. Choosing to use ACA software can help ensure compliance with ACA regulations alongside accurate reporting and regulation updates.

Let's take a look at two such software tools for ACA reporting.

ACA Reporter

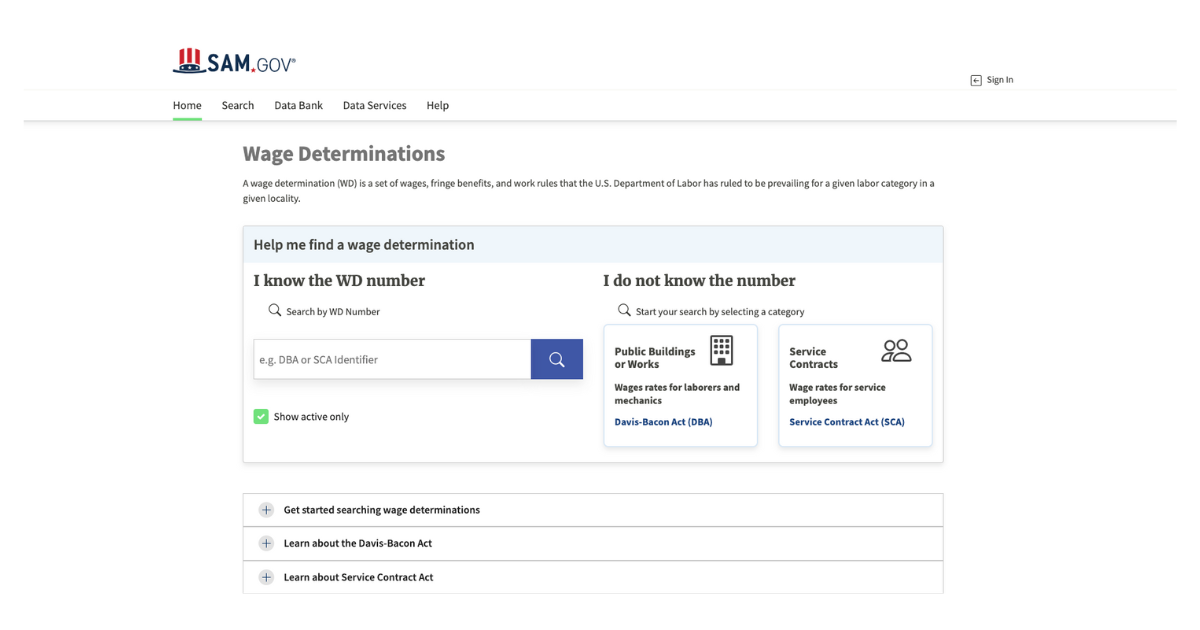

Points North’s ACA Reporter is a software solution to all the complexities and potential penalties of filing ACA data. Our tool ensures compliance with the IRS by doing three things very well:

1. Tracking relevant data

2. Reporting required information

3. Analyzing everything

At the end of the process, the ACA Reporter user is provided with an easy-to-understand analysis. Whoever is in charge of ACA reporting can use this information to prove they're on track with ACA requirements.

If you fall off track with ACA compliance, then ACA Reporter can help you out as well. It starts by sending a simple notification telling you that you’re out of compliance, then follows that up with actionable steps you can take to re-align yourself with ACA requirements.

Simplify Your Annual ACA Reporting With Points North

Staying in compliance with ACA regulations is essential if you're an ALE. The process of doing so can be a bit complicated, but luckily there are software tools to simplify the process.

Points North provides ACA Reporter to help ensure your annual ACA reporting gets done in an accurate and timely manner. Contact us today to learn more.

.png)