Underpayment of construction workers remains an ongoing problem with Price Waterhouse Coopers estimating their paychecks fall short by $320 million every year.

It’s the reason federal regulations like the Davis-Bacon Act exist. Requiring contractors to follow local prevailing wages helps ensure workers receive the pay, benefits, and overtime they earn. State and local municipalities might set their own wage requirements as well, so you need to know how to deal with prevailing wages if you pursue government contracts.

You have to follow them when you set your wages, but do you have to include them in the wage reports you file with the government?

Here’s what you need to know about wage reports and what you have to include in them.

What Are Wage Reports?

Before we cover what to include in wage reports, let’s take a look at what they are. These wage detail reports are also referred to as certified payroll reports as they summarize your payroll data. They’re certified because when you sign them, you certify that the information in the report is true and correct.

For federal contracts, you submit a report weekly for the life of the project. Note that this isn’t the same as quarterly tax reports and returns like Form 941. Those cover your tax liabilities and go to the IRS rather than the Department of Labor.

These forms are used to confirm that they are paying prevailing wages as required by Davis-Bacon. The projects don’t even have to be completely government funded, only partially as long as it hits a minimum amount. The rules typically apply to projects on public buildings or those involving public works.

What Are the Main Parts of a Wage Report?

For most contracts, the certified wage report is the only paperwork needed to stay in compliance with Davis-Bacon. All of the information should be easily pulled from your payroll system.

The report doesn’t have to be filled out on a form WH-347, but it does need to include all the requested information on that form.

Along with your company’s identifying information, you’ll need to provide a list of employees for the week. For each employee, you will need to break out the following data:

- Full name and ID number

- Job classification

- Number of hours worked

- Overtime hours

- Rate of pay including fringe benefits

- Gross wages earned

- Deductions and withholdings

- Net wages

Employee information should not include personally identifying details like social security numbers or addresses.

Your subcontractors need to be included in the reporting, although they have to file their own reports as well. You can include their report in your report. Remember to review them as you are ultimately responsible for their activities.

These reports don’t cover salaried employees in certain positions as the purpose of the wage report is to confirm you’re paying people correctly. Those positions don’t fall under prevailing wage laws, which apply to workers whose primary duties include manual labor. Most salaried employees are considered exempt under the Fair Labor Standards Act.

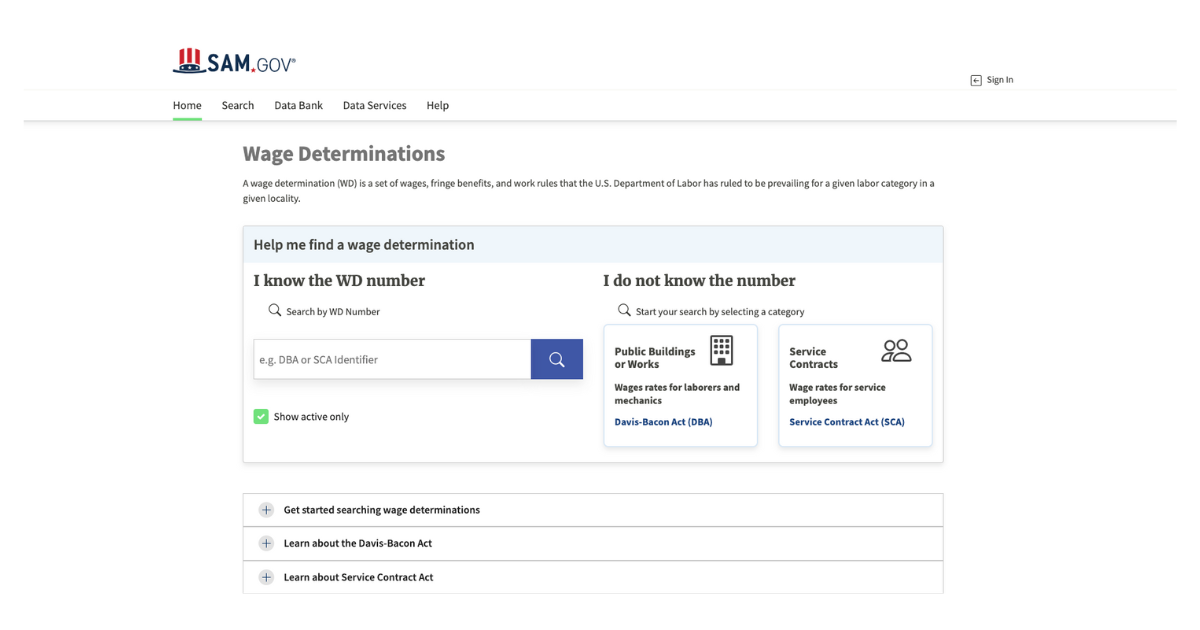

Where Do Prevailing Wages Come In?

If you’re still wondering “do I have to report prevailing wages”, you should know that there isn’t a section or spot on the wage report form that calls for that. However, prevailing wages still come into play in a couple of ways related to your weekly reports.

Prevailing-wage requirements for federal projects are governed by Davis-Bacon, but there are many state and local laws as well that have them. The wage is set based on what is paid to others in your area on similar projects that aren’t government-funded.

The Department of Labor (DOL) pulls the data for the wage list through Form WD-10, which surveys construction companies in the building, heavy/highway, and residential sectors. The results of that survey determine average pay and fringe benefit rates.

If not enough contractors fill out the WD-10, the DOL can use certified payroll reports from ongoing projects in the area to help figure out a prevailing wage. While you don’t put a prevailing wage on your report, your report could be used to determine a prevailing wage.

Use of Wage Reports for Compliance

The main use of your wage report is to ensure you are paying the prevailing wage as stipulated by your contract. It’s your job to know what that wage is and to be paying it.

The Department of Labor will look at the rate of pay you supply, which is the basic hourly rate of pay for each employee. Fringe benefits might be part of the wage determination and should be part of the report if you participate in approved programs.

If your wage rates turn out to be less than the prevailing wage, you will be asked to pay wage restitution to everyone who was underpaid. The contract administrator will notify you if there’s an issue, and you’ll have 30 days to correct it. Underpaid employees have to be paid promptly and fully, minus regular deductions.

Need Help with Reporting Wages?

For employers with government contracts, keeping up with wage determinations and filing the correct wage reports can become a daunting task. It’s important to know which pieces of information need to be on your certified payroll reports. The government will check your reports to confirm you’re paying prevailing wages for your area, determined by the data you provide on the Form WD-10.

Specialized payroll software can help you keep up with all the wage report guidelines for construction companies that do government contract work. Contact us to talk about your project and our solution for your company.

.png)