The IRS lowered the employer health plan affordability threshold for 2022 to 9.61% of pay cost-sharing. Under FPL Safe Harbor, the cost is limited to $103.14/month for self-only coverage.

The IRS announced that employer-sponsored health coverage would be deemed affordable under the Affordable Care Act requirements if the lowest-cost, self-only coverage option does not exceed 9.61% of an employee's income. In 2021, the threshold was 9.83 percent, which rose from 9.78 percent in 2020.

During the preceding calendar years, the IRS adjusts the affordability threshold based on the ratio of premium growth to income growth. The premiums for employer-sponsored health coverage in the year 2021 increased at a lower rate than national income growth due of the surged COVID-19 cases, which resulted in a drop in the use of non-emergency health care services. Therefore, the affordability percentage for 2022 dropped below the 2021 level.

Who Needs to Worry About ACA Affordability?

The ACA Employer Mandate applies to employers that qualify as Applicable Large Employers, or ALEs. According to the ACA, the employers having at least 50 full-time employees (along with members in the controlled group) are referred to as ALEs. These include full-time equivalent employees, for at least 50% of the prior calendar year.

Employers who fail to remain compliant with IRS mandates receive a penalty letter; IRS Letter 226J. Employers who received the IRS Letter 226J should take this notice very seriously and put steps into place to get back into compliance to avoid hefty penalties.

Cost Sharing limits

The Federal Poverty Line (FPL) Affordability Safe Harbor puts limitations on employers in 2022. Employers offering a health plan option with employee-only coverage less than $103.14/month will meet affordability standards. The maximum premium payment for a 2021 plan using the FPL safe harbor could not exceed $104.53 per month.

The affordability threshold for non-calendar-year plans will be 9.83% in 2022. Additionally, non-calendar-year plans will not be able to determine the FPL safe harbor contribution limit after January 1, 2022. It will not be applicable until the Department of Health and Human Services issues the 2022 FPL guidelines in January or February.

Affordability Safe Harbors

Under the ACA, the affordability threshold is the highest percentage of household income of an employee, required to pay monthly insurance premiums. The Minimum Essential Coverage is determined by comparing the least expensive employer-sponsored plans that meet the ACA's requirements.

Applicable Large Employers will not know the household incomes of their employees. There are three affordability Safe Harbors that ALEs can use to determine the annual affordability threshold. Employers may use any of the following safe harbors based on the information they have about their employees:

- Employees' W-2 wages, reported in Box 1, generally on the first day of the plan year.

- Rate of pay: The rate of pay for employees in the plan year is the hourly wage rate multiplied by 130 hours per month. While the pay rate for a salaried employee is 9.83% of the monthly salary as of the first day of the coverage period.

- The individual Federal Poverty Level: The Department of Health and Human Services publishes the poverty level near the start of the New Year. FPL's safe harbor simplifies ACA reporting and coding that plan sponsors need to conduct for each employee on a health plan.

An Overview of how the Affordability decrease of 9.61% in 2022 will affect Employers:

2022 Affordability Percentage Decrease to 9.61%:

According to the IRS, the ACA affordability percentage will decrease from 9.83% in 2021 to 9.61% in 2022.

2022 Lowest-Cost Plan is No More Than $103.14/Month:

In 2022, companies will meet the Affordable Care Act affordability standards based on the employee’s coverage costs. The employers offering less than $103.14 per month for employee-only coverage will automatically meet the standard. Employers in such situations should benefit from the Affordability Safe Harbor set by the federal government. ASH deems coverage for all full-time employees, along with the qualifying offer to simplify ACA reporting.

2022 Lowest-Cost Plan Exceeds $103.14/Month:

According to Affordability Safe Harbor, the lowest-cost employee-only plan must not exceed $103.14 per month. Some employer’s plans may not meet the 2022 Federal Poverty Line Affordability Safe Harbor. Such employers offering more than $103.14/ month should generally utilize the rate of pay affordability safe harbor. This approach requires a straightforward analysis of the lowest pay rate of employees. Hourly pay rate for the hourly full time employees; as well as, the lowest monthly salary for salaried full time employees will be considered.

2022 Contribution Strategy Considerations:

Consider these affordability Safe Harbors when designing employee contribution levels for 2022. It will help employers to avoid potential ACA employer mandate “B Penalty” liability. Employers must consider offering at least one medical plan option to full-time employees where possible. It should be for employees of regions with an employee-share of the premium not exceeding $103.14/month for employee-only coverage. It will help employers to simplify affordability compliance.

The lead benefits counsel at Newfront, Brian Gilmore says: “Wherever possible, employers should use the federal poverty line affordability safe harbor. It makes coverage automatically affordable and eliminates the need for per-employee calculations.”

On Aug. 30, the agency announced the 2022 affordability threshold in Revenue Procedure 2021-36. It is also known as the shared-responsibility affordability percentage or cost-sharing limit.

Lyndsey Barnett, an attorney at Graydon in Cincinnati, writes; “if this percentage goes down, employers might have an unaffordable plan.”

The Bottom-line

The affordability percentage for the year 2022 dropped from that of 2021. During the preceding calendar year, the IRS adjusts the affordability threshold based on the ratio of premium growth to income growth. Due to increased COVID-19 cases, the premiums for coverage increased at lower rates. Therefore, the affordability determination rules can be complex. Employers with major medical plans not exceeding more than $103.14/month should use the federal poverty line affordability safe harbor. While those with medical plans of more than $103.14/month, should utilize the rate of pay affordability safe harbor.

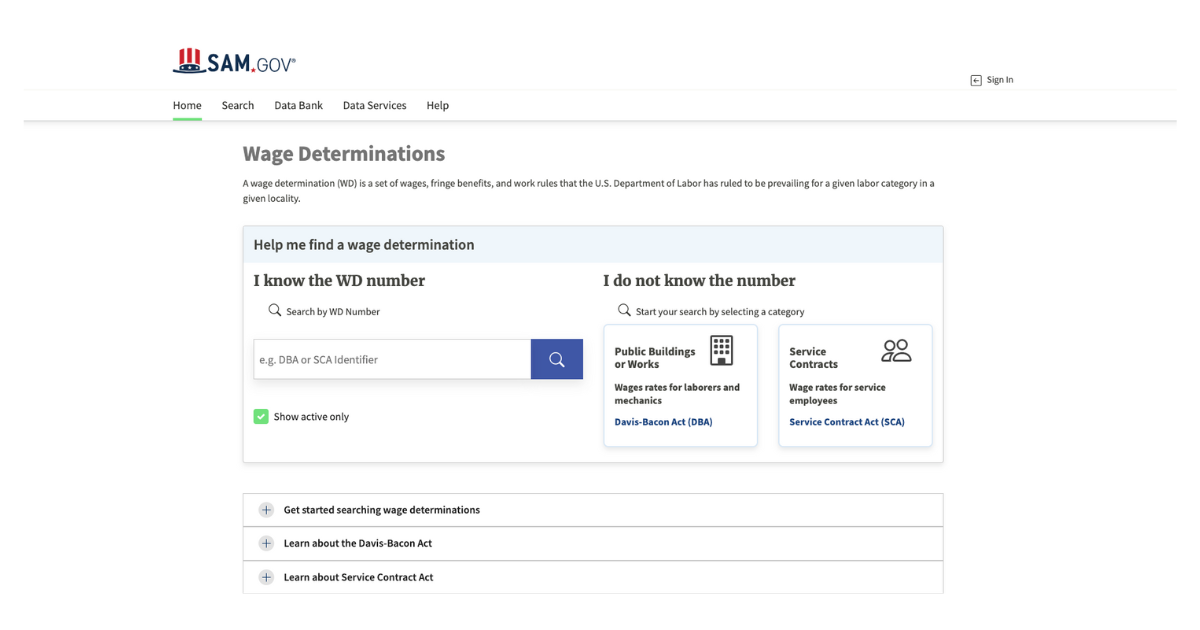

.png)